Transparent Lending

You Can Trust

We provide financial institutions with seamless integration so they can streamline loan origination, approval, and disbursement processes. Using our API, we ensure an efficient credit assessment, reduce manual workload, and accelerate loan approvals by providing secure data transmission and real-time verification capabilities.

Approaches to Addressing Lending Challenges

The Problem

A loan origination, an on-boarding process, a credit underwriting process, and a collection process can pose many challenges for lending institutions.

The Solution

Zrika's APIs can be used by lending institutions to create tailored workflows that will help them convert their user base in the most efficient manner possible.

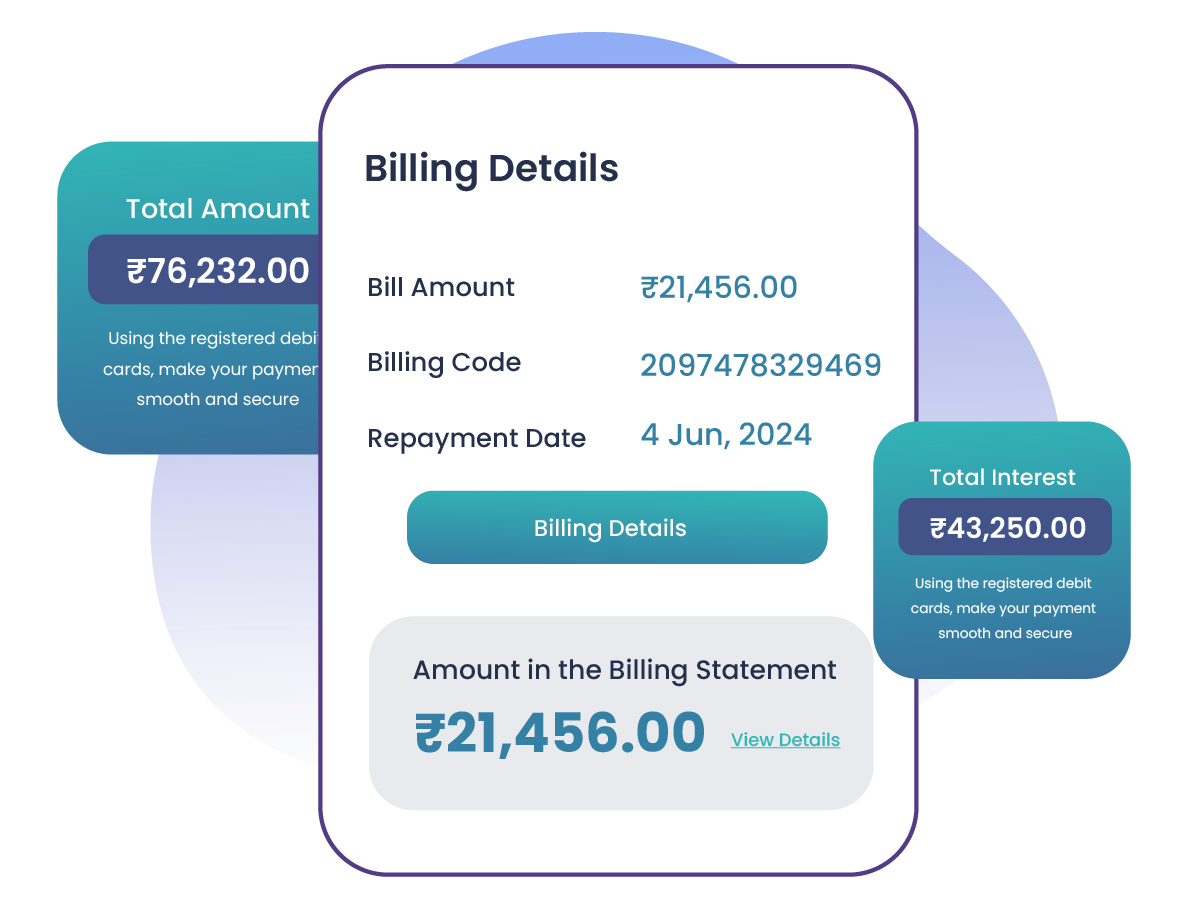

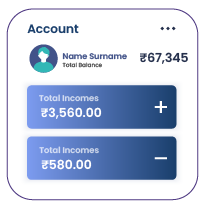

Banking Made Clear

Modern lending platforms are powered by an API stack that provides comprehensive tools to optimize lending processes. The API stack we offer includes identity verification, credit scoring, real-time financial data analysis, and seamless payment integrations.

-

Aadhaar eSign Integration

-

Streamline Your Payments

-

Analyze Your Customers' Finances

-

Power Payments Over BBPS

FAQs Made Easy for You

Break free and realize your limitless financial potential with Zrika.