Precision Financial Planning

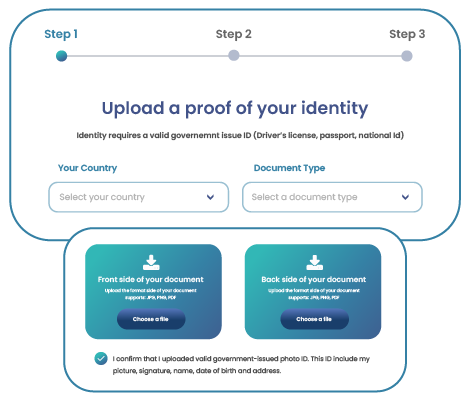

We offer KYC solutions that simplify the onboarding process for businesses and individuals. We ensure compliance with regulations while providing a hassle-free and fast verification process. KYC uses cutting-edge technology to verify customer identity seamlessly, so you can focus on what really matters: your business.

Compliance Made Easy and Secure

Verifying data for a Versatile Banking Experience

Bank Account Verification

Verify your bank account and ensure seamless financial transactions. The rapid verification of account details reduces fraud risk and ensures security.

DigiLocker Integration

Our DigiLocker integration allows for paperless KYC verification. Enhance user onboarding with quick and easy document storage, management, and sharing.

Aadhar Verification

Aadhar verification ensures the authenticity of our services. Build customer confidence by utilizing India's national identification system to validate identities.

PAN Verification

Our PAN verification service enables seamless financial transactions. Verify customer identity and prevent fraud with our PAN card validation process.

Secure Your Digital Finance

Establish a process for onboarding and verification of your customers, whether you are a lender, an investment or insurance platform, or a service provider.

Verify Enterprises

Our enterprise verification process ensures the authenticity of businesses. The digital ecosystem is protected by rigorous corporate data validation.

Provide insurance

We simplify KYC verification for insurance applications. Streamline insurance coverage, claim processing, and policy management by verifying customer identities.

Enable investments

Users can quickly register with PAN or Aadhar before investing in stocks or mutual funds. A seamless investment process is enabled by fast investor verification.

E-commerce Onboarding

Verify the bank account details and PAN of sellers on e-commerce sites. Onboarding accelerates online commerce. Enhance security and customer confidence.

Verifying Workers

Verify driving licenses, PAN/Aadhaar numbers, and bank accounts. KYC verification ensures accurate identity checks, ensuring safe food delivery and transportation.

BNPL or Credit

BNPL (Buy Now, Pay Later) and credits streamline the process of offering flexible payment options while ensuring compliance with regulatory requirements.

Start Banking with Us Effortlessly

Compliance Assurance

Easily comply with regulatory requirements. Our KYC processes adhere to industry standards and legal regulations, ensuring your business operates legally.

Streamlined Onboarding

Get rid of cumbersome paperwork and time-consuming verifications. Using our KYC services, businesses are able to attract and retain customers quickly and easily.

Customer Trust

We develop customer trust by implementing KYC procedures that are rigorous. You can increase your reputation and attract more clients when your business is credible.

Reduced Operational Costs

Automating KYC processes reduces manual errors and operational costs. You can focus on core business activities and growth initiatives as a result of this efficiency.

Clarity for your

KYC Concerns